ABSTRACT This paper proposes a broader theoretical view of the process of determining the indicative value of a commercial enterprise. A methodlogical framework of commercial companies’ valuation toolkit is presented. The features of the traditional approaches, ...

ABSTRACT The international division of labour is a factor and source for the formation of modern production structure, which generates a change in the international competitiveness of the national economies. The dynamics of modern international trade is ...

Nowadays, when the world seems to be moving faster and faster along the path of its evolution, transformations in the education system can be defined as dynamic, diverse and non-linear. Globalization and the easy access to huge amounts of information from anywhere in ...

Foreign models for assessing the insolvency risk of enterprises are an effective way of forecasting a financial position, therefore, they should not be directly excluded from the analytical tools used in Bulgaria. At the same time, these models, developed in ...

This monograph examines the possible ways to manage labour conflicts in business organizations. Within the framework of the identified problems, an in-depth analysis of the literature has been carried out, through which a conflict is defined as a multifaceted and ...

Digital transformation of a business is essential for its successful operations in today's dynamic environment. In order to extract maximum value from data and improve their operational efficiency, modern companies invest in intelligent environments based on new ...

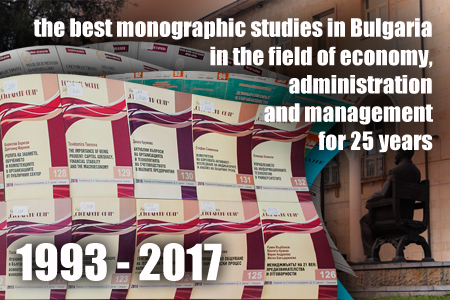

The "Business World" Library is a specializsed edition with longer than a quarter-century history, which publishes the monographic studies of authors from higher schools and scientific organisations in Bulgaria and abroad in the field of economics, administration and management. It was established in 1993 in response to the need of the scientific production to gain more publicity and to assist the authors in their academic advancement. Its first and longtime

REQUIREMENTS FOR SUBMISSION OF PAPERS FOR THE "BUSINESS WORLD" LIBRARY

The monographic studies, submitted for review, should meet the following requirements:

1. The monographic study should be research-oriented, present thorough research of a complex scientific issue that has been developed individually or collectively, contain original high-level theoretical and practical research with an expanded structure (content).

SMART BUSINESS ENVIRONMENTS: INTEGRATION OF BIG DATA, IoT AND ARTIFICIAL INTELLIGENCE

Digital transformation of a business is essential for its successful operations in today's dynamic environment. In order to extract maximum value from data and improve their operational efficiency, modern companies invest in intelligent environments based on new technologies. The aim of this scientific research is to explore the potential of Big Data, Internet of Things (IoT) and Artificial Intelligence (AI) technologies for improving smart business environments and their role as tools for ...

MANAGEMENT OF CONFLICTS IN BUSINESS ORGANIZATIONS - STRATEGIES, METHODS AND TACTICS

This monograph examines the possible ways to manage labour conflicts in business organizations. Within the framework of the identified problems, an in-depth analysis of the literature has been carried out, through which a conflict is defined as a multifaceted and dynamic phenomenon that determines the social space. The main idea is that the concept of organizational conflict management, in the context of modern management, requires the use of new methodological tools for more effective ...

ASSESSMENT OF THE INSOLVENCY RISK OF ENTERPRISES

Foreign models for assessing the insolvency risk of enterprises are an effective way of forecasting a financial position, therefore, they should not be directly excluded from the analytical tools used in Bulgaria. At the same time, these models, developed in socio-economic conditions that differ from the Bulgarian ones, suggest that they should not be immediately applied without a thorough and targeted study. Such studies contribute to the application of foreign analytical models with ...